Why Commodities in 2023?

Sep 06, 2023Last modified at Mar 18, 2024

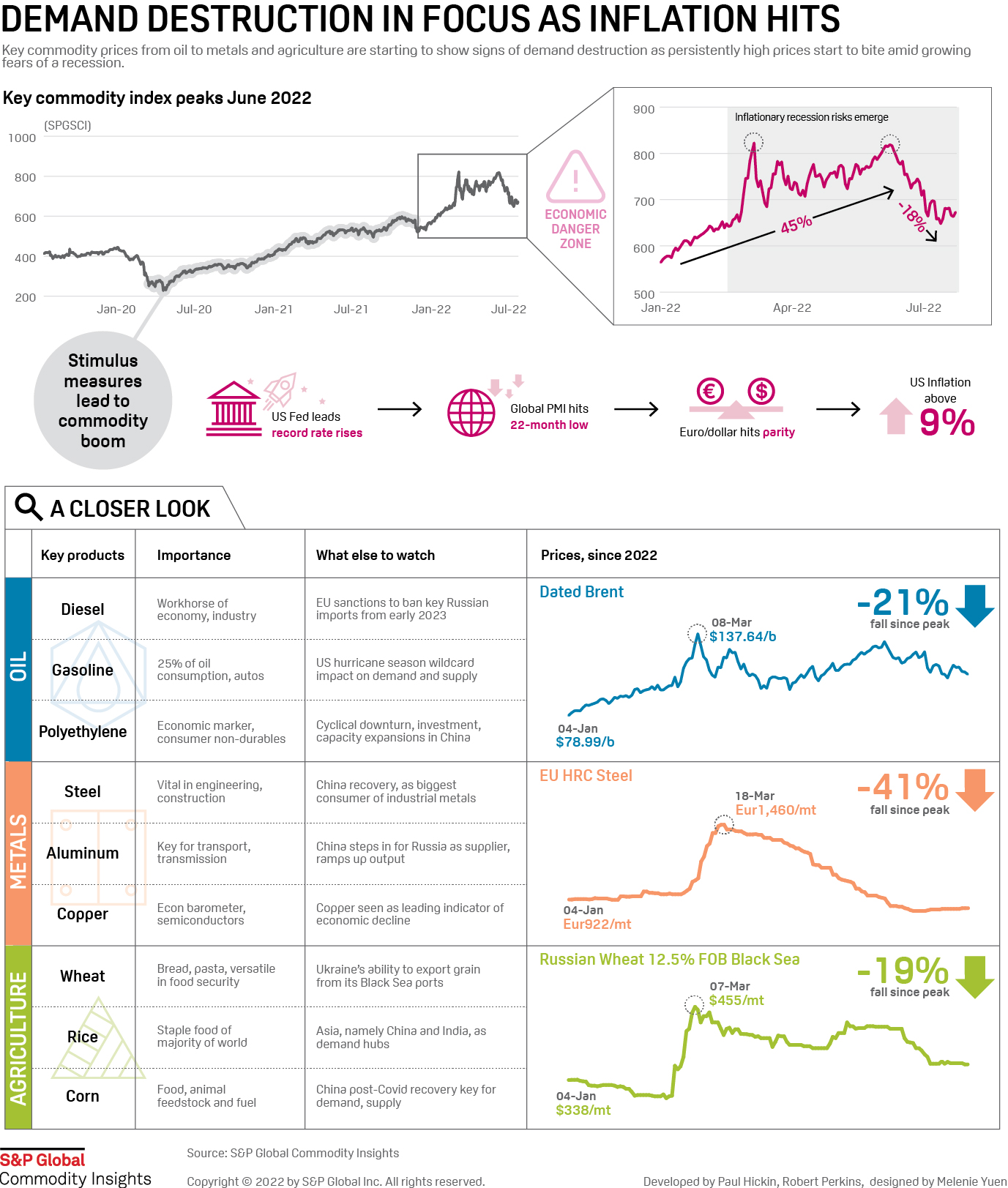

Does the following chart look familiar to you?

Yeah, this is from 2022. So you might say, “it was just a temporary event in 2022. The inflation is getting lower, and a lot of the global economies are coming towards soft landing..”

We disagree. We believe that the importance of the global commodities market will escalate for the next 20 years, if not 50 years and will be the key deciding factor of the global economy.

Here are our three reasons:

-

The globalized world trade is no longer accessble

The global economy has fragmented ever more since the 1950s, with rising restrictions inhibiting free trade of assets worldwide. Rising tensions between the US and China over major technologies critical to each economy has resulted in sanctions over companies that are critical to each others’ economies and further technological development. Some analysts debate whether recent trade restrictions amount to a strategy of complete economic decoupling, a harbinger of a decline in trade. The Dollar regime alongside the US military dominance is being questioned, accelerating multi-polarity.

Some bold claims would be:

- The world economy would be decoupling between major powers, leading to trading blocks that entails de-dollarization.

- There would be a major War outbreak in the next 5-10 years (most possibly in Taiwan, Middle East, or even East Europe)

- Supply-chain shocks that originated from the Ukrainian War will be a norm in such regimes, and the global commodities market will become more volatile and illiquid.

When this happens, global trade would be in complete paralysis. Specifically, global trade would be in chaos on two levels. First, global commodities trade would be fragmented into the US allies trading block, Chinese ally trading block (and possibly neutral trading block). Considering that China has been expanding its mining investments for the last 15 years along with its Belt and Road initiative, China controls 45% of the global strategic raw materials in 2021.

Global trade would be fragmented geographically, just like it did right between the First and the Second World War. Second, the global commodities market would be void of a settlement currency. Without a dominant world reserve currency that dollar once enjoyed a status of, producers (or buyers) would be unwilling to be paid in the currency from the other side (i.e. Chinese traders would not receive US dollars and US traders would not receive Chinese Yuan).

-

American dominance is no longer a given

Look at Hamas’ attack on Israel. Look at the Ukranian war that was predicted to end in the first three months.

These factors include

- Establishment of exchanges that were supervised under government oversight such as NYSE, CME, LME, HKEX, etc.

- Legal, political framework that accelerated opening of capital markets between such exchanges across borderlines

- Protection of major global trade routes provided by the US Navy, but it is coming into question over China’s expansion into Southeast Sea and economic expansion into Africa and Middle East

Moreover, such world order was possible for two main drivers:

- The US was supplying the global economy with printed USD albeit trade deficits and budget deficits

- The US economy was heavily dependent on a robust supply of oil from the Middle East. So the US had the motivation to be in charge of Global trade using its military dominance.

Such drivers are fading away both internally and externally from the US, and at the same time the US’ strategic focus is shifting over East Asia and the semiconductor industry.

-

Commodities will elevate its position as a “unrivaled reserve” of a future currency

Zoltan Pozsar writes in his writing Bretton Woods III:

“…you pay with dollars for commodities and the Fed and private banks (G-SIBs) police the par, interest (and bases), and foreign exchange aspects of the nominal side of the commodities trade, while sovereign states police the legal and military aspects of commodity trades so that shipping companies and commodity traders can move tonnages around.”

Although with certain assumptions, Zoltan draws parallel between the global dollar economy with the commodity market. One thing he did not consider in his piece is that creating new type of world currency that is linked with the global commodity market has become easier than ever, with blockchain infrastructure and turing-complete smart contracts available from anywhere on earth.

Some interesting reads to get you started

Henry Kissigner on World War III

Henry Kissinger explains how to avoid world war three

Petro-dallar is undergoing stress points

Saudi Arabia Open to Talks on Trade in Non-US Dollar Currencies

Recent talks that our team is listening to..

A Great Depression Worse Than 2008 - Survive & Thrive During The New Economic Reset : Arthur Hayes